Coinbase, Finance 2.0, & the path to a global, open financial system

Originally posted on medium.com.

The following post analyzes trends in the cryptocurrency market, reviews Coinbase’s competitive positioning / business model / risks / prospects, and provides recommendations for the company to capture additional value by leveraging concepts taught in Wharton’s Tech Strategy MBA course. Special thanks to Michie Adachi, Andrew Felbinger, Kevin Tse, and Toni Wei for their contributions. Thanks for taking the time to read and welcome all feedback!

Coinbase Overview

Coinbase is a digital asset broker that offers a platform for buying, selling, transferring, and storing digital currency. The company is one of the earliest to focus on making cryptocurrencies accessible to mass consumers. Founded in July 2011 by Fred Ehrsam and Brian Armstrong, Coinbase is headquartered in San Francisco and has ~200 employees.

Its primary products are its consumer wallet and trading platform for retail investors and Global Digital Asset Exchange (GDAX) for professional and institutional investors to trade in digital currencies. Beyond its Consumer Platform and GDAX, Coinbase has expanded into several other products as it works to capture additional pieces of the cryptocurrency market. This diversified suite of products includes an API developer platform, the Toshi browser for Ethereum, and various merchant tools (Figure 1).

Figure 1: Coinbase Product Suite

As an exchange, Coinbase generates most of its revenues from transaction fees (i.e., 1–4% depending on country of origin and size of purchase) for purchasing and selling four major cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. The company offers a hosted digital currency wallet service free of charge. The company passes down network transaction fees, such as bitcoin miners’ fees, to consumers, when virtual currencies are transferred to addresses off the Coinbase platform.

Today, Coinbase operates in 33 countries, with the largest volume coming from the United States and the European Union. It has supported more than $50 billion worth of digital currency exchanges across more than 13 million customers. Its breadth of product, global footprint, and unique capabilities make it the easiest place for retail and institutional investors to invest in cryptocurrencies.

Its scale and consumer reach have attracted significant interest from venture capital firms and other investors. To date, Coinbase has raised more than $217 million from prominent investors such as Andreessen Horowitz, DFJ, and Union Square Ventures. Most recently, in August 2017, the company raised $100 million Series D financing at a $1.6 billion valuation — the first blockchain-related company to reach unicorn status. In addition, it has received funding from the New York Stock Exchange and several “traditional” banks. This investment from mainstream financial players is a critical signal to both cryptocurrency and broader financial markets of Coinbase’s potential as a viable alternative to traditional financial institutions.

While arguably the most well-known, Coinbase is not alone. Coinbase faces numerous competitors in the digital currency trading and brokering space, but maintains a set of strong competitive advantages (Figure 2). Coinbase has relatively low transaction fees and a strong reputation, particularly in the US and Europe. Unlike competitors, Coinbase has prioritized working alongside regulators, an unusual strategy in a decentralized industry in which most players have tried to render regulators obsolete. Additionally, Coinbase has approval from the FDIC to operate an exchange in New York. Additionally, if you are a US resident, the Coinbase USD Wallet (in fiat) is covered by FDIC insurance, up to a maximum of $250,000.

These features combined with a focus on an easy-to-use consumer interface and experience have made Coinbase one of the world’s largest bitcoin brokerage platform.

Figure 2: Competitive Assessment

Cryptocurrency Market Developments

Coinbase is well-positioned to capitalize on the growth and excitement of the broader cryptocurrency market. Cryptocurrencies are digital assets designed as a store of value and a medium of exchange. Unlike traditional currencies which are controlled by a central authority or bank, cryptocurrencies are decentralized and managed by the collective network. Cryptocurrencies have several benefits over traditional fiat including reduced risk of fraud and counterfeit, immediate settlement, lower fees, and financial inclusion for the underbanked.

Cryptocurrencies leverage cryptography to secure transactions and verify the transfer of ownership of assets over peer-to-peer networks. Every transaction is approved and authenticated by a group of miners and recorded on a shared digital cryptographic ledger called the Blockchain. Miners are individuals and private enterprises who have a financial incentive to maintain the security of the ledger using computing power to validate and timestamp transactions.

On October 31, 2008, Bitcoin, the first cryptocurrency, was introduced to the world in a whitepaper published by an individual or syndicate under the pseudonym “Satoshi Nakamoto.” Satoshi envisioned a “purely peer-to-peer version of electronic cash [that] would allow online payments to be sent directly from one party to another without going through a financial institution.” The value of Bitcoin has since increased significantly, hitting an all-time high of $20,089 on December 17, 2017 and a total market capitalization of $334 billion. 2017 was an inflection year for Bitcoin with the value increasing~14x from $963 to $13,411 (as of December 31) and daily volume peaking at $22 billion (Figure 3).

Figure 3: 2017 Bitcoin price growth (data from coinmarketcap.com)

This market growth has concurrently propelled Coinbase to over 13 million users (as of November 2017), with over 100,000 new accounts added this Thanksgiving alone (Figure 3). On December 11, 2017, Coinbase was ranked as the #1 App on the Apple iTunes store, a remarkable feat given that the top 10 free apps list has long been dominated by the Tech Giants, Facebook and Amazon.

Figure 3: Growth of Coinbase Userbase

Although Bitcoin is the most well-known cryptocurrency, it is not the only one. Over time, Bitcoin’s dominance of the overall cryptocurrency currency market has declined and currently accounts for roughly 55% of total market capitalization. Bitcoin faces competition from other digital coins, known as Altcoins, such as Ethereum, Litecoin, NEO, Monero, and Dash. These altcoins are generally derived from the same source code as Bitcoin but vary in terms of transaction speed, hashing algorithms, distribution schemes, token economics, privacy features, scalability, and usability, among other factors. As of December 31, 2017, there were over 1,372 cryptocurrencies trading with a total market capitalization of $575 billion (Figure 4).

Figure 4: Top 10 cryptocurrencies by market cap (Source: Coinmarketcap.com)

Over the years, cryptocurrencies have received a lot of negative publicity, particularly as it relates to their usage for illicit transactions and money laundering over the internet, with some calling the asset class a Ponzi scheme. Given the rapid increase in prices, pundits are increasingly concerned that the asset class is a bubble. Despite these risks, cryptocurrencies have become more mainstream in 2017 with investors looking to get exposure to the volatility of the asset class (Figure 5).

Figure 5: Bitcoin’s pricing concerns

Transition to an Open Financial World

Exactly how the cryptocurrency market will evolve is unknown, but industry leaders have their hypotheses. In his blog post named “The Coinbase Secret Master Plan” published in September 2017, Coinbase Co-Founder and CEO, Brian Armstrong outlined where he thinks the digital currency industry is headed and how the world will come to have an open financial system. Armstrong believes the development of the cryptocurrency industry has and will continue to follow four phases (Figure 6).

Figure 6: The Coinbase Master Plan to Capture Value from Transition to Open Financial System

1) Protocols (2009 — Present)

The development of the cryptocurrency industry is often compared to the initial development of the Internet. Consumers regularly use internet applications that leverage protocols that power the web (e.g., TCP/IP, SMTP) without fully understanding their underlying technical standards. However, many Internet users forget that the initial years of the development of the Internet were mired with infighting and that the mainstream adoption of protocols took more than a decade.

Similarly, developers in the cryptocurrency industry have spent the last 9 years focused on conceiving, operationalizing, and scaling open-source protocols (e.g., Bitcoin, Ethereum) that will enable the open financial system. The initial development of protocols predates Coinbase, which has not played a major role in this stage of the evolution of the cryptocurrency market. However, the company regularly supports, sometimes financially, the open-source community. The race is now on to see which protocol attracts the most support from the developer community.

2) Infrastructure (2012 — Present)

Investment is rapidly pouring into cryptocurrency infrastructure (i.e., exchanges and secure wallets) to allow users to access and use digital assets. With the Internet, the deployment of Internet Service Providers and lay fibers provided users with services to access and use the Internet. Similarly, Coinbase has been actively involved in building out digital asset infrastructure (i.e. Coinbase for consumers and GDAX for institutions) to allow users to buy and sell cryptocurrencies. Given that mainstream adoption of cryptocurrencies hit an inflection point in 2017, we may be nearing the end of this phase.

3) Consumer Interface (2018+)

Users need an easy interface (i.e., HTML, browsers) to use digital currency applications. In digital currency, this is likely to happen when a web browser equivalent allows users to control their own wallets. Coinbase is generating significant revenue from its core businesses (e.g., Coinbase Consumer, GDAX) and plans to use surplus capital to build or invest in teams working on a mass market consumer interface. In April 2017, Coinbase launched a beta version of Toshi, a private and secure messaging app, a user controlled Ethereum wallet, and browser for Ethereum apps. While Toshi has yet to become mainstream, the application demonstrates Coinbase’s commitment to facilitate “digital currency’s shift from speculative investment to a global payment network.” Coinbase also announced the appointment of David Marcus, vice president of messaging products at Facebook and former president of online payments at PayPal, to its board of directors, to help in this transition.

4) Decentralized Applications (2018+)

The final stage of the cryptocurrency market will be the development of decentralized applications globally accessed via the aforementioned new consumer interface. Developers will rebuild the financial system on open networks using new decentralized applications spanning lending, venture capital, investing, identity & reputation management, remittance, and merchant processing. Coinbase will participate by buying, building, or investing in various companies. A robust consumer network is a critical prerequisite to incentivize app developers and to leverage network effects.

Coinbase Business Strategy

With this technological evolution in mind, the Coinbase “Secret Master Plan” articulates two main strategies to capitalize on market opportunities. The first is to be the easiest place to buy and sell digital currency. To this end, the company has built a consumer friendly, trusted, and secured wallet and exchange to trade digital currency — accessible even to cryptocurrency novices from their smartphones. The company is actively adding new countries and payment methods to its platform and building relationships with regulators and banks around the world to promote adoption.

Coinbase’s second strategy is to help the cryptocurrency industry grow by building application prototypes. With the launch of Toshi (Figure 7), the company has begun to execute on this strategy by using its cash-cow businesses to invest in future bets (e.g., Ethereum consumer interface and accompanying decentralized applications) before being disrupted by new players.

Figure 7: Toshi — the browser for the Ethereum network

However, despite its hockey-stick user growth (Figure 3), Coinbase also faces numerous ecosystem challenges that are stunting its growth. As Adner and Kapoor explain in “Right Tech, Wrong Time,” for potentially transformative innovation, “it may pay to focus a little less on perfecting the technology itself and a little more on resolving the most pressing problems in the ecosystem”.

For Coinbase, these problems include keeping the platform online during hours of unusually high trading volume (Figure 8), while protecting assets from sophisticated hackers trying to steal funds (Figure 9).

Figure 8: Coinbase high traffic issues

Figure 9: Security is a key focus

To address these issues, the company is investing to provide a better quality of service and increase the scale with which it can reliably serve customers. More specifically, Coinbase has rapidly scaled up its engineering team to protect and secure its technology and has recently introduced a customer support line (Figure 9).

Figure 9: Coinbase’s investment in customer support

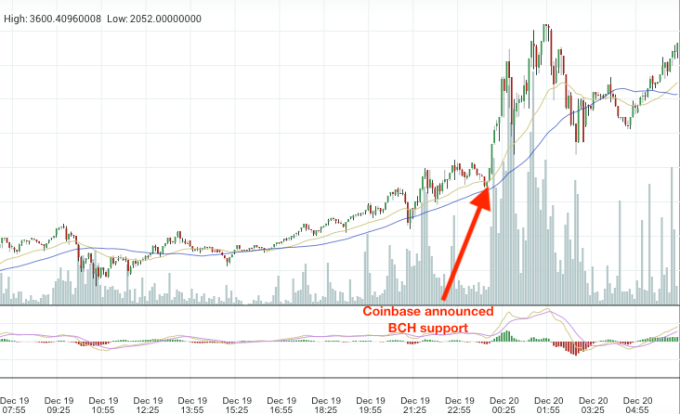

Additionally, Coinbase has struggled to add new cryptocurrencies to its platform. The company has published a framework through which it evaluates which new coins to add to its platform. On December 19, Coinbase started to allow customers in qualifying countries to buy, sell, send and receive Bitcoin Cash, the currency created in August’s hard fork. While Coinbase had previously announced its plans to add Bitcoin Cash by January 1, 2018, the launch was botched. Firstly, the price began to increase pre-official announcement (Figure 10).

Figure 10: BCH launch on Coinbase

After the launch, $BCH was trading ~3x more on Coinbase than on any other listed exchanges. That volatility led Coinbase to freeze transactions, creating plenty of confusion in the process. Just a few hours later and in response from outcry from the crypto community, the company disclosed that the chaos had prompted an insider trading investigation and the threat of employee agreement terminations (Figure 11).

Figure 11: Coinbase insider trading investigation

Finally, Coinbase has struggled to navigate an evolving regulatory framework. While the company benefits from being based in the US and working with regulators, the company is involved in an ongoing lawsuit with the IRS which is seeking account information for users on the platform engaged in transactions worth $20,000 or more. In response, Coinbase has invested heavily to enhance its identity verification and compliance processes including Know-Your-Customer (KYC) and Anti-Money Laundering practices.

On December 1, 2017, the company announced the appointment of Asiff Hirji as President and Chief Operating Officer to help manage its growth through these challenges. Hirji joins from Andreessen Horowitz — though he’s also served executive roles at Hewlett-Packard and TD Ameritrade.

Digital Currency S-Curve

Digital currency presents an extremely complex case study for S-curves. While the entire asset class itself is a curve, the underlying technology — and arguably, each of the numerous individual currencies — all have their own curves that both support and compete against each other.

The traditional S-curve centers around the changes in return on investment (ROI) throughout the lifecycle of a technology, in terms of the amount of marginal improvement in the technology’s performance measured against the amount of effort invested into developing those improvements. In their nascence, technologies will begin on a fairly flat curve, as huge upfront investments are required to develop and prove the concepts. At a certain inflection point, this base becomes stable, and additional investment begins to yield greater and greater returns. However, in the latter half of the curve, the improvements again begin to slow as the technology is optimized, and marginal performance gains often take increasingly money and/or effort to attain. Based on our analysis, we believe that cryptocurrency is still in the nascent stage at the bottom, flatter portion of its S-curve — although it is beginning to near the inflection point (Figure 12).

Figure 12: Started at the bottom [of the S-curve] and now we here…

While adoption has started to move closer toward the mainstream, it is still very small relative to traditional currencies. Additional cryptocurrencies and features are constantly being added, but these improvements still come at a fairly high cost, and the asset faces significant difficulties in scaling. Mining Bitcoin, for example, currently expends as much energy as many countries (currently ~Qatar and Bulgaria) (Figure 13). These resource requirements place limits on the expanded and widespread use of Bitcoin and fuels a lot of the competition among 2.0 cryptocurrencies that are focused on improved scalability.

Figure 13: Bitcoin Energy Consumption data from: https://digiconomist.net/bitcoin-energy-consumption

In addition, there is a strong ecosystem need for both consumers to readily adopt digital currencies and for sufficient infrastructure to support the supply and demand. Significant investment in this regard is needed for cryptocurrencies — and Coinbase — to be able to reach the baseline point where improvements build easily on one another and returns on investment start to greatly increase. In the absence of a well-built-out ecosystem, the industry must be on the bottom, flatter part of its S-curve.

Of course, the newer cryptocurrency S-curve must be paired with an existing one — traditional currency. Given the extreme uncertainty surrounding the future of digital currencies, particularly in relation to existing fiat, it is not immediately obvious that either one is robustly moving toward dominance. This clear “discontinuity” — the gap between the two curves — suggests as well that cryptocurrency is still in the beginning stages, when it shows promise, but the existing technology is not obviously degrading. As a result, consumers are still largely uninformed about the benefits of the new technology, and are unsure whether to entrust their wealth to it.

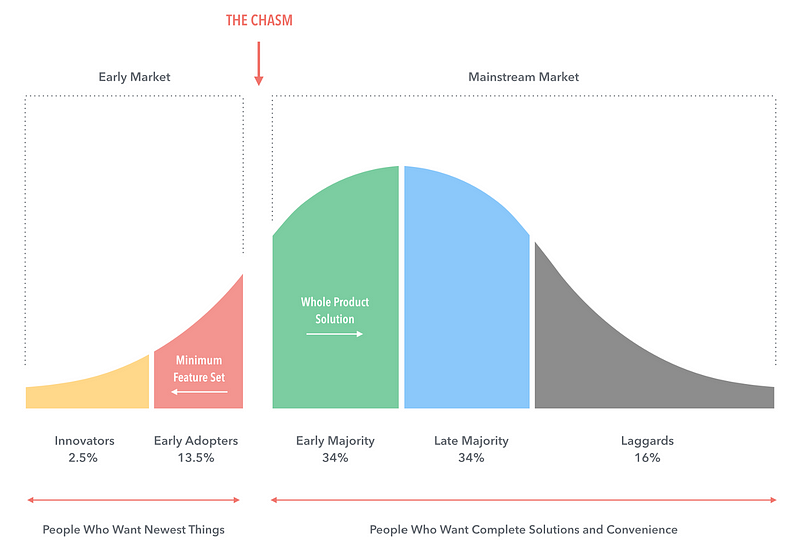

It has been estimated that less than 5% of worldwide households have used cryptocurrencies. At a minimum, players has moved from being early innovators and hackers to early adopters (Figure 14). But cryptocurrencies have yet to cross the chasm to reach the mainstream market. This is likely to happen in Phases 3 or 4 identified above — once the Consumer Interface and decentralized apps make the technology more accessible to daily use cases.

Figure 14: cryptocurrencies market adoption

And, traditional institutions differ wildly on their opinions, with some banks, like USAA, investing in cryptocurrency, and some — like JP Morgan’s Jamie Dimon, vehemently dismissing it. If we continue the comparison to internet adoption, cryptocurrencies are in the very early years, and we can expect an exponential increase in global penetration in future years. Traditional banks’ unwillingness to engage in the space can also be seen as defensive, as a true jump to the digital currency S-curve would undermine their entire existences. As described in “The S-Curve: A New Forecasting Tool”, this gap period is “chaos”[1]. This turmoil is clearly reflected in the wild price fluctuations and diverging approaches to this rapidly growing asset class.

Finally, even as the larger concept of digital currencies is on one S-curve, within the industry there are many competing entities and currency types that are all somewhat different and represent multiple S-curves. There are currently more than 1,300 different cryptocurrencies on the market, and more can be created at any time. Each of these digital currencies has a different origin and features that make it more or less attractive to different sets of users. For example, Ethereum is known for its capacity for smart contracts, while Dash is a dark-web currency that specializes in being fast and anonymous. Each of these currencies competes with the others for market share, and they are developing at different rates — along separate S-curves. This easily creates confusion around what S-curve is at which point in its trajectory. In this confusion, speed of development is key to determining which curves win out in the market.

Coinbase is one of the premier exchanges for Bitcoin (the original cryptocurrency and clear leader, with a market capitalization of more than $220 billion), Ethereum (the second most widely used digital currency, valued at more than $70billion), and Litecoin (a version similar to Bitcoin, also valued at more than $11 billion). These digital currencies started early in driving market share and network value, and are likely to have a longer trajectory while other newer currencies expire. Coinbase’s extensions outside its core GDAX product into other areas that address digital currency needs, such as a consumer interface, show that it is investing heavily in planning for and building out the ecosystem — which should help to increase the slope of the S-curve and reach large-scale growth faster.

What about the Traditional Financial Institutions?

Traditional financial institutions have almost entirely remained on the sidelines throughout digital currency’s rise to power over the past half-decade. Many major players in Wall Street have not only remained neutral but have in fact publicly slandered the broad digital currency market describing it as “fraudulent” and “idiotic” and even calling players in the space “stupid” and “deserving of their inevitable downfall”.

Tidjane Thiam, CEO of Credit Suisse, explained that banks have “little or no appetite” to get involved with Bitcoin and any of the digital currencies because of not only the fear of a future bubble bursting but also because of the illicit activities that have been historically associated with the space. Banks have been under an increasingly tight and watchful eye from regulators post 2008 and entering the digital currency space would provide significant “anti-money laundering challenges” that may not be worth the risk. Further, Jamie Dimon, CEO of JP Morgan Chase, has been perhaps the most visible and vocal bear of the digital currency space going as far as to call it a “fraud” (Figure 15).

Figure 15: Incumbent responses to new technology

In his book, Innovator’s Dilemma, Clayton Christensen describes the main reason incumbents, in this case banks and traditional financial institutions, have been reluctant to invest in the new technology and enter the digital currency space. (Figure 16). The key reason for this is a dilemma pushing traditional financial institutions out and allowing firms like Coinbase to establish themselves and capture market share is because the disruptive innovation (i.e., digital currency exchange) requires significant iteration and revision.

Figure 16: Clayton Christensen’s Innovator’s Dilemma

Traditional financial institutions have the luxury of a large customer set but with it comes high expectations of revenues and profitability. These established players must invest to maintain expected sales and profitability targets and therefore cannot commit the significant resources required for disruptive innovation. As a result, financial institutions will not enter the market until the upstarts such as Coinbase are approaching the near-vertical inflection point in their S-Curve trajectory.

Further, Coinbase is radically disrupting incumbents by threatening both existing business models and their core assets (Figure 17). By using blockchain technology as transaction verification Coinbase directly counteracts the inherent business model of traditional banks who transact only with institutional partners after careful vetting, regulatory approval and extensive Know-Your-Customer processes. Coinbase’s business model also lends itself to an ‘asset lite’ model as opposed to traditional incumbents who rely on heavy staffing compliance with various regulatory bodies and traditional exchange platforms.

Figure 17: Core Business Model vs. Assets Matrix

With the worldwide bond market an estimated $82 trillion dollars, the worldwide equity market an estimated $69 trillion dollars, the digital currency space for many years was far too small to justify significant attention and investment from bulge bracket international investment banks with many of their assets, and revenues, coming from significantly larger asset classes. Even after the recent surge in digital currency pricing across a majority of the 1,300+ currencies, the worldwide market capitalization of all digital currencies is just $575 billion. All that said, however, banks are receiving more pressure from investors and clients alike and are beginning to change their message. As banks such as Goldman Sachs and Barclays begin to publicly acknowledge that they are exploring expanding operations to service the digital currency space, and as digital currency futures begin to trade through traditional exchanges, this potential direct competition to Coinbase is a key risk that the company cannot ignore.

Disrupting the Disruptor

Serving as an exchange for digital currencies, Coinbase is dependent on the continued proliferation and success of the underlying virtual assets. Any key risks in the broader digital currency space present inherent (and very real) potential challenges for Coinbase that cannot be ignored.

The Elephant in the Room

Bitcoin futures products began to trade on the CBOE on December 10th, 2017 and on the CME on December 17th, 2017, representing the first major milestone in Wall Street’s entrance in to the digital currency space. While this represents a huge win for the broader digital currency market — bringing what digital currency bulls are calling an air of greater legitimacy to the space — and exchanges like Coinbase, it also brings with it the greater likelihood of entrance from traditional bulge bracket investment banks like Goldman Sachs, JP Morgan Chase, Morgan Stanley, Citi, and Barclays. This new futures market, according to CNBC, also offers “the first real two-way market, where investors can use their brokerage accounts to short Bitcoin for the first time,” something Coinbase and other exchanges have not had to deal with to this point.

In December 2017, in response to client interest in digital currencies, Goldman Sachs is setting up up a trading desk focused on bitcoin and other cryptocurrencies, according to a report from Bloomberg.

Low Barriers to Entry

The early days of the digital currency spaced were billed as the building blocks to an open financial system (e.g., free of government backing, regulatory bodies). This core value also presents exchanges like Coinbase with significant risk because of the extremely low barriers to entry. Not surprisingly, the open source API and ‘free’ information has led to over 1,000 different exchanges and platforms, all of whom can be defined as competition to Coinbase, that have been created to provide access into the digital currency space.

Hacking and Consumer Protection

The digital currency landscape has not been referred to as the online wild west for naught — it was by design. Creating a universal platform without the need for government intervention was a key driver to the success of platforms and exchanges like Coinbase but have also introduced a new potential threat: hacking.

Since 2011 there have been over three dozen reported heists of cryptocurrency exchanges where over 980,000 Bitcoins have been stolen — worth a staggering $15 billion. With almost none of the stolen currencies ever recovered many of the hacked exchanges have subsequently shut down.

Coinbase handles billions of dollars per day in transactions of currencies that aren’t backed by any governments or central bank. “If you’re a consumer, there’s nothing to protect you,” David Yermack, chairman of the finance department at NYU’s Stern School of Business has explained. This online wild west seldom has any type of sheriff present which has led to a dramatic increase in the number of assaults by hackers. This growing and potentially fatal risk is top of mind for all exchanges with Coinbase being no exception.

Recommended Path Forward

As more startups enter the competitive space of cryptocurrency exchange, Coinbase will need to differentiate itself by identifying gaps currently in the cryptocurrency ecosystem and fill them in, either by forming strategic partnerships, investing in future players, or creating an open platform. In doing so, Coinbase can position itself as an indispensable part and market share leader of the cryptocurrency world.

We have identified three key recommendations that will enable Coinbase to extend the old technology curve (moving towards the dashed line), extend the new technology curve (moving from dotted line to the solid line to the left), and make the transition jumping from one curve to the other (Figure 18).

Figure 18: S-Curves & Extensions from “Right Tech, Wrong Time” (Adner & Kapoor)

Recommendation 1: Invest in the current S-curve of Bitcoin by increasing Bitcoin support for payments and banking

Although Bitcoin’s stated ambition is to be a “new kind of money”, we hesitate to label Bitcoin a “currency” as it is more a store of value rather than a medium of exchange. As Sam Lessin opines in his editorial, “14 Ways the Cryptocurrency Market Will Change in 2018”:

“I don’t think we are on the brink of seeing consumers use cryptocurrencies to buy real world goods and services. This is mostly because the on- and off-ramps between the crypto ecosystem and local currencies remain just too difficult […]”

However, what Lessin sees as a problem in the ecosystem is what we view as an opportunity for Coinbase to unleash the potential of Bitcoin as a form of payment. Currently Bitcoin takes, on average, 10 minutes to register a transaction and uses roughly 5000 times more energy than a Visa transaction. These numbers are completely unsustainable if Bitcoin were to scale to 1 billion users. Coinbase can improve the viability of Bitcoin while owning a defensible moat through strategic partnerships. For example, Coinbase can collaborate with payment processors such as Square or Stripe to allow businesses to accept Bitcoin payments from Coinbase wallets. Additionally, Coinbase should consider integrating and funding “off-chain” solutions such as Lightning, which will provide much-needed scalability and speed to Bitcoin. Lightning enables two parties to exchange Bitcoin without needing to post their transactions to the public blockchain, which is time-consuming and expensive. If the two parties exchange Bitcoins frequently, only the net amount is posted to the public blockchain. With a Lightning collaboration, Coinbase can position itself here as a trusted exchange for these types of transactions. These two initiatives will fill in ecosystem gaps around daily transactions while simultaneously inserting Coinbase as a pivotal bridge for navigating the Bitcoin network.

As more consumers begin to use their Coinbase wallets for transactions, Coinbase can pivot in the long-term to being a cryptocurrency bank and engage in traditional lending activities. Based on Bitcoin’s frosty reception from Wall St. CEOs, it is unlikely that Coinbase can form strategic partnerships with Wall St. banks to bridge Coinbase wallets to checking accounts and will instead have to forge its own path.

One possible path that Coinbase could take is reinventing the fractional reserve banking system in the cryptocurrency world, such as small consumer lending or margin trading with funds held in Coinbase wallets.

Recommendation 2: Fund the next S-curve of Ethereum via subsidies

Unlike Bitcoin, Ethereum was built from day one to accommodate transactions from one party to another via “smart contracts”. With the second-largest cryptocurrency market cap (after Bitcoin), a much higher growth rate (105x increase in value YTD vs. 16x increase in value for Bitcoin), and innovative smart contract technology, Ethereum is better positioned to not only be a store of value but also a viable medium of exchange.

As one of the largest wallet holders in the world, Coinbase is uniquely positioned to own key elements of the Ethereum platform. Coinbase has already taken steps to open access to Ethereum via Toshi, the “WeChat for Ethereum” which provides users the ability to interact with Ethereum apps that can be funded with Coinbase wallets. Coinbase can cement its defensive moat with Toshi by keep its developer API open, well-documented, and free. Creating an open platform is a smart strategy to help Coinbase orchestrate external networks that complement its ecosystem and make its platform even “stickier” for consumers and developers.

However, Toshi alone cannot spark viability in Ethereum. In “Pipelines, Platforms, and the New Rules of Strategy”, Van Alystne, Parker, and Choudary explain how companies might have to “subsidiz[e] one type of consumer in order to attract another type”. Coinbase should follow this advice by subsidizing developers to fill in the ecosystem gaps around Ethereum by funding developers directly, either by awarding an annual prize for best Ethereum app or providing grants to multiple developers to develop their respective Ethereum apps. Another approach would be for Coinbase to fund open-source development of Ethereum by donating to the Ethereum Foundation or providing grants for development tools.

Recommendation 3: Make few, but meaningful investments and switch S-curves when Ethereum begins to overtake Bitcoin

Our final recommendation dictates how and when Coinbase should prioritize multiple cryptocurrencies. We look to the Back Bay Simulation for guidance in the timing of Coinbase investments. In the simulation, the key strategy to managing disruption was investing in innovation without losing focus on existing assets. Winning R&D strategies milked their cash cows, while investing year over year to seed future innovation. This strategy provided consistent cash flows in the ramp-up period before the disruptive technology bore fruit and allowed Back Bay to seamlessly switch to the new S-curve in the long-term. Similarly, Coinbase should make short-term investments to capture value in Bitcoin, while placing long-term bets in Ethereum.

More specifically, Coinbase should not neglect their Bitcoin “cash cow” while interest is high and growing, especially around payments and banking. Concurrently, Coinbase should keep a narrow focus on just Bitcoin, Ethereum, and to a lesser extent Litecoin, instead of expanding to new currencies. As some teams discovered in the simulation, supporting numerous development projects spread resources too thin and exposes the company to disruption and competition from smaller, niche players.

Finally, Coinbase should be patient in transitioning from Bitcoin to Ethereum. None of the investments will bear fruit for at least a year (in Ethereum’s case, probably not for at least another three years). This is a small time to wait to fill key gaps in the cryptocurrency ecosystem. Coinbase should switch to focusing on Ethereum as soon as daily volume trades begin to approach Bitcoin levels, off-network transactions are supported on Ethereum, and real-life payments are possible with Ether. Because of Bitcoin’s deflationary nature and deliberate trade-off in favor of inefficiency vs. integrity, Bitcoin cannot be the future of monetary currency. When the above prerequisites have been met is when Coinbase should jump to the Ethereum S-curve.

[1] Foster, Richard N., “The S-Curve: A New Forecasting Tool,” Innovation: The Attacker’s Advantage.

![Figure 12: Started at the bottom [of the S-curve] and now we here…](https://images.squarespace-cdn.com/content/v1/5c337413e2ccd1b37156532b/1549136674219-7K6WHXKI7CL3VNBHY5WR/ec2cb-16vr1xqpmt0mgnep2w7uduq.png)

![[1] Foster, Richard N., “The S-Curve: A New Forecasting Tool,” Innovation: The Attacker’s Advantage.](https://images.squarespace-cdn.com/content/v1/5c337413e2ccd1b37156532b/1549136667816-T43W4LTA7BJ6RU8RYGSM/03b8a-1iitusrlrhdu-vmvgykqxbg.png)